CRITICAL THOUGHTS

While we take pride in walking advisors through the transition process, there are critical elements we evaluate during the process that most advisors, and even other recruiters don’t even consider.

Underlying Topics Not Discussed

From miscellaneous fees to technology stacks, most advisors aren’t fully aware of the key questions that need to be asked.

"Trusted" 3rd Party Recruiter?

You realize you’re not equipped to make a broker-dealer change alone. So why consider a 3rd party recruiter?

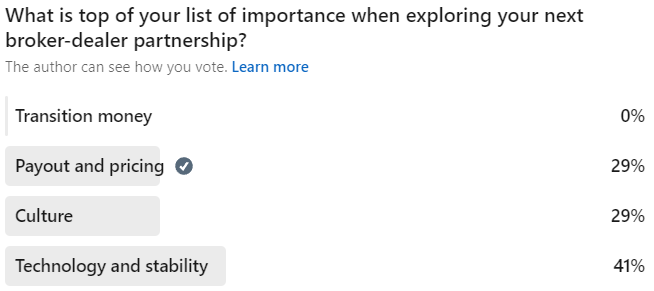

Poll: Key Consideration In Making a Move

Between transition money, payouts and pricing, culture and technology, you may be surprised at the results of our poll!

Future Topics Coming Soon

We are working hard to publish critical thoughts to help you can gain a competitive edge. Stay tuned!

Future Topics Coming Soon

We are working hard to publish critical thoughts to help you can gain a competitive edge. Stay tuned!

Future Topics Coming Soon

We are working hard to publish critical thoughts to help you can gain a competitive edge. Stay tuned!

UNDERLYING TOPICS NOT DISCUSSED

From miscellaneous fees to technology stacks, most advisors aren’t fully aware of the key questions that need to be asked.

Having spent 18 of my 22 years in the financial services industry in corporate America you can bet that I have seen it all. One area that has always baffled me with this industry is the due diligence process when looking for a new broker-dealer partner. There are so many miscellaneous fees, mandatory fees, pricing, technology stacks, etc. that most advisors don’t know to ask some of the questions that will affect them in the long-term. For example, does the broker-dealer charge an additional program fee for certain money managers? Do they change transition money if an advisor is going to an OSJ vs. going direct? Who owns the client data in the CRM system should you leave? The list goes on and on.

I truly don’t believe the broker-dealer or their staff are hiding these items on purpose, but let’s be honest, they all have goals to meet. Below, I will break down some of the vital areas you should be looking into when making a broker-dealer change. These are the very reasons why a team like Trusted Visions is so important to work with when seeking a new broker-dealer.

Additional fees:

Every broker-dealer has mandatory affiliation fees, although they all name them differently. Some name them monthly service fees, affiliation fees, or E&O, etc. This is an area you really want to pay close attention to, because many broker-dealers mark these fees up above and beyond what they are paying. Simply ask the recruiter how much these areas are marked up and which fees are marked up. In addition, some broker-dealers charge an additional program fee for you to use third-party money managers. This is a very important question to ask when conducting your due diligence. This additional fee can be as high as 5 bps. more! Lastly, you always want to pinpoint the exact account termination fees should you decide to leave that broker-dealer.

Transition money:

While most advisors say that the money is not part of their decision-making process, it always comes down to money. Two areas I would like to focus on this section are:

- The transition package itself.

- Will transition money change if an advisor joins your OSJ vs. going direct with the broker-dealer

Just because a broker-dealer is offering 2, 3 or 4 times more than the rest of the broker-dealers doesn’t mean they are the best fit. Most, if not all times this happens it is simply because they are either desperate to get more advisors, or they cannot compete with other broker-dealers. In that case, they have no choice but to offer substantially more.

If you are a recruiting enterprise or OSJ, it is important that you ask your potential next BD partner if they change the transition money for a recruit that wants to join your OSJ versus going direct to them. This is huge when analyzing the dollars that can be offered to an incoming prospect. It certainly can be a deal breaker for a number of prospective advisors!

Recruiting number/financials:

In this final section I wanted to cover an area that many times is never discussed or brought up during the due diligence process. First, you have many firms out there touting they have had a record recruiting year. While that is great news, it is important to delve into the details. For example, there is a firm currently stating they had a record recruiting year for 2021. That is a strong point and it gives you a nice, warm and fuzzy feeling knowing you may be moving to a firm that is showing solid growth. However, the devil is in the details. What this particular firm is not saying is that ¾ of the recruited GDC in that so called “record recruiting year” were firms that were already with them, yet they purchased their practice! In my opinion, if the GDC and assets were already with your firm, how do you count them again as recruiting GDC?

Secondly, it is important that you look at the firm you are interviewing in terms of how much in GDC or assets did they recruit in the previous couple years, but more importantly, how much in GDC or assets did they lose in that same year. If a firm recruiting $50 million in new GDC, but then lost $30 million in GDC, that raises some red flags. There are several ways to obtain these numbers, but it is an area that should be reviewed without question.

The last portion of this topic, which I would say 99% of the time is overlooked is asking for your potential broker-dealers financials. Many broker-dealers will push back on this. Simply ask yourself, “why is there push back if they have nothing to hide?” This will give you a great overview of the financial status of that broker-dealer. Let’s be honest. We are in an ever-consolidating marketplace and it looks like it is only going to continue. You want to ensure that your next potential broker-dealer partner has plenty of cash reserves and isn’t running their business all on credit.

These are just a few areas that are simply overlooked when seeking a new broker-dealer. At Trusted Visions, we have over 100-years combined experience in the financial services industry. We are here to walk alongside you to ensure we are taking a detailed and serious approach to finding you the best broker-dealer partner. We don’t take this responsibility lightly! You are trusting your career with us and we want to ensure you are asking the questions you don’t always know to ask or don’t think to ask. Call or email us today to set-up a confidential consultation at (346) 703-3070 or email jbelfiore@trustedvisions.com

“TRUSTED” 3RD PARTY RECRUITER?

You realize you’re not equipped to make a broker-dealer change alone. So why consider a 3rd party recruiter?

I have spent 20-years in the financial services industry as a Business Development professional. Still, to this day I remember my journey in getting into the industry like it was yesterday. In late 2000, I was recruiting for a private college and absolutely despised the high-pressure sales tactics of doing everything possible to obtain a $25 application fee. Most couldn’t afford the $25 and I knew the program they were enrolling in would not be the career they would enjoy. One day, I received a call from a good friend of mine. He said there was a local firm looking for a recruiter. I told him, “Bill I have no desire to be a recruiter. I am looking at other options and want to get out of recruiting, because of the high-pressure sales tactics.” He said, “Jeremy go meet with the Head of Business Development and the President/CEO. This isn’t your typical sales position.” Reluctantly, I went and met with the President/CEO and Head of Business Development and it was a day I will never forget.

After a long day of interviewing with multiple people, I met with the President/CEO and the first question he asked me was, “what do you think Jeremy?” I told him, “Tom, I think that there are many great people within the organization and the firm is great as well, however, I really don’t see myself in a high-pressure sales position. It’s just not me.” The words after answering that question from Tom were words I will never forget. Tom told me, “Jeremy I don’t ever want you to sell anything. If you accept this role, I want you to focus all your energy on building strong and trusting relationships with every advisor you work with, make a 100 dials a day for the first two-years of your career, and most importantly, never mislead or misguide an advisor. Act with the highest level of integrity, ethics, and honesty and you will be successful in this industry. Those are words that have stuck with me throughout my career as a Business Development professional throughout my career and words that I have done my best to live by each day.

While there have been ups and downs throughout my career, as well as many sacrifices that I and my family have had to make, I must admit I love what I do. Having made mistakes along the way with focusing on the right business versus the wrong business, pushing too hard to get a decision from a prospect, or taking a loss too personal, I have always strived to act with the highest level of integrity, honesty, and ethics.

As I reflect, in every industry there are always the bad apples that spoil the bunch. You see, I take it extremely seriously when I am working with a prospective financial advisor, because they are trusting their livelihoods, their ability to take care of their family and their clients’ livelihoods in your hands when making a decision to make a broker-dealer change. I take pride in being upfront and transparent. It is just as important to cover the areas where your firm could be better and not just covering the benefits of your firm to the advisor. This isn’t a sign of weakness, but more so a sign of you doing what is right. I’ve always strongly believed that if you place your clients needs in front of your own, you don’t ever have to worry about the financial gain you will receive. That will come naturally by doing right by your client.

Another item I strongly believe has made me successful in this industry is my responsiveness and willingness to speak to a prospective advisor anytime. Many people believe that if a prospect is calling you at 7 pm at night that they are needy or a pain. In reality, here is an advisor that has everything to lose should he/she make the wrong decision, so don’t you at least owe them your time? Yes, taking time away from your family, whether it’s on the phone at night or traveling is not something anyone wants to do, but it is the sacrifice you have to make in order to be the best at what you do. I am a competitive person by nature so the last thing I want to do is lose or not be one of the top recruiters on a team. However, I have learned you can still achieve that without sacrificing what is in the best interest of your client.

Below, I have listed just some of the areas where I feel that we as Business Development professionals have an obligation to our clients to do our very best:

- While sometimes it may cost you losing a deal, always act with the highest level of integrity, ethics, and honesty.

- Don’t hide certain information, because you don’t think your client will like the answer. Whether it pertains to hidden costs, payouts, or policies. Be transparent with your client.

- When a client contacts you, no matter what time or day it is, be responsive to their needs. They have a lot of questions and uncertainty. It is your job to talk through the concerns they have.

- Get to know your client first, both personally and professionally. Don’t try and sell them anything before getting to know them.

- Never attempt to sell a client for your own personal financial gain. If your firm is not the right fit, then be honest. If you are a 3rd party recruiter, don’t just send a prospect to a prospective broker-dealer because that broker-dealer pays you more than the others.

- While the role of a Business Development professional can be grinding and a lot of work, understand the vital role you play in your client’s and their family’s livelihood.

These are just a few of the areas that you as a Business Development professional should feel obligated to do. We are all blessed to have the ability to make money, ultimately being in a role that only we are in control of the success or failure we achieve. You must put in the work to be successful. Many firms in our industry have lost sight of what has made them successful; the clients they serve. That doesn’t mean that you have to do the same. We have a duty to serve our clients, as Tom put it, “with the highest level of integrity, ethics, and honesty.”

I hope that you have enjoyed reading this short blog. I would love to hear your comments at info@trustedvisions.com or, if you would like to learn more about how we work with Business Development professionals, please contact us.

POLL: KEY CONSIDERATIONS WHEN MAKING A MOVE

Between transition money, payouts and pricing, culture and technology, you may be surprised at the results of our poll!

Hope everyone had a fantastic Easter weekend! Last week, the Trusted Visions team executed a poll on LinkedIn. Our connections were asked the following and here are the results:

It was interesting, as I would assume Transition money and Payouts and pricing would rank 1 and 2. However, Technology and stability ranked number 1, Culture ranked second and Transition money received ZERO votes.

Given that, if your broker-dealer partner has been sold, are going through changes, or the service and support you receive is far below par, isn’t it time to explore your broker-dealer options?

Call or email the Trusted Visions team at (346) 703-3070 or email me at jbelfiore@trustedvisions.com